Strategic Philanthropy in Today's Environment

Philanthropy has evolved from simple charitable donations to a sophisticated financial strategy that can simultaneously advance important causes while providing significant tax benefits and estate planning advantages. In today's economic environment, strategic philanthropy offers high-net-worth individuals powerful tools to maximize both their charitable impact and their financial efficiency.

Strategic Advantage

Modern philanthropy is no longer just about giving money away—it's about creating sustainable impact while optimizing tax efficiency and supporting long-term wealth transfer goals. Today's environment offers unprecedented opportunities for strategic charitable giving.

The Evolution of Strategic Philanthropy

Traditional charitable giving often involved writing checks to favorite organizations without much strategic consideration beyond the immediate tax deduction. Today's sophisticated philanthropists approach charitable giving with the same strategic mindset they apply to their investment portfolios and estate planning.

Strategic philanthropy considers multiple objectives simultaneously: maximizing charitable impact, optimizing tax efficiency, supporting family values and education, creating lasting legacies, and integrating with overall wealth management strategies. This comprehensive approach transforms philanthropy from a cost center into a strategic asset.

Understanding Tax-Efficient Charitable Giving

The tax benefits of charitable giving have become increasingly important as tax rates have evolved and more sophisticated strategies have emerged. Understanding these benefits requires looking beyond simple deduction calculations to consider current and future tax implications, asset type considerations, and timing strategies.

Key Tax Benefits of Strategic Philanthropy

| Strategy | Tax Benefit | Best For | Key Advantage |

|---|---|---|---|

| Appreciated Securities | Avoid capital gains + deduction | Long-term appreciated assets | Double tax benefit |

| Charitable Remainder Trusts | Income stream + deduction | Retirement income needs | Lifetime income + charity |

| Charitable Lead Trusts | Remove appreciation from estate | High appreciation potential | Estate tax reduction |

| Private Foundations | Full deduction + control | $5M+ giving goals | Maximum flexibility |

| Donor-Advised Funds | Immediate deduction + grants | $100K+ annual giving | Simplicity + flexibility |

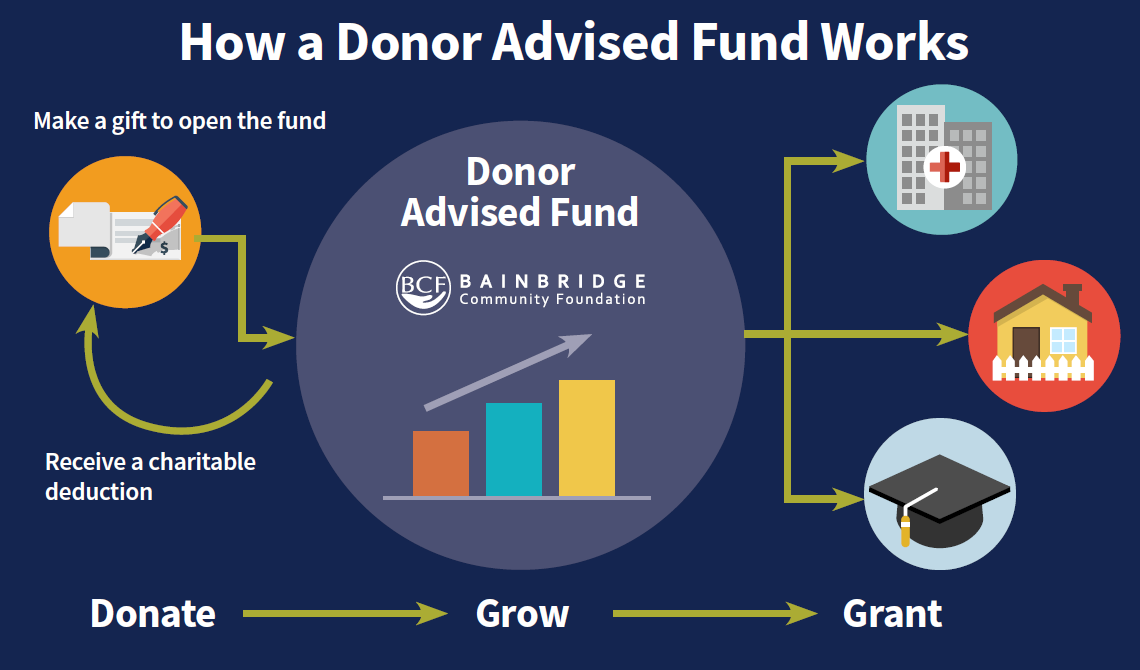

Donor-Advised Funds: The Middle Ground Solution

Donor-advised funds (DAFs) have experienced explosive growth in recent years, and for good reason. They offer many of the benefits of private foundations with significantly less complexity and cost. A DAF allows you to make a charitable contribution, receive an immediate tax deduction, and then recommend grants to charities over time.

DAF Advantages in Today's Environment

- Immediate Tax Deduction: Receive full tax benefit in the year of contribution, even if grants are made later

- Investment Growth: Contributions can be invested for growth, potentially increasing future giving capacity

- Simplicity: No complex administration, governance, or compliance requirements

- Flexibility: Advise on grants while avoiding private foundation regulations

- Cost Efficiency: Much lower cost than establishing and maintaining a private foundation

- Anonymity Option: Ability to give anonymously through the fund

DAF Investment Strategies

Modern DAFs offer sophisticated investment options that can significantly enhance your giving power over time. Consider these investment approaches:

- Balanced Growth: For donors who want growth potential while maintaining stability

- ESG Integration: Environmental, social, and governance screens that align with values

- Thematic Investing: Investments that support specific charitable causes

- Socially Responsible: Screen out companies that conflict with charitable values

Advanced Charitable Strategies

Charitable Remainder Trusts (CRTs)

CRTs provide lifetime income while supporting charity, making them particularly attractive for retirees or those approaching retirement. The donor transfers assets to a trust that pays income to the donor or other beneficiaries for life (or a term of years), with the remainder going to charity.

Case Study: CRT for Retirement Income

A 68-year-old entrepreneur with highly appreciated stock and no immediate liquidity needs established a CRT. She transferred $2 million of Apple stock to the trust, avoiding $400,000 in capital gains taxes. The trust pays her 6% annually ($120,000) for life, and she receives a significant tax deduction. Upon her passing, the remaining assets benefit her alma mater.

Outcome: Lifetime income, significant tax savings, and meaningful legacy support—all achieved through one strategic transaction.

Charitable Lead Trusts (CLTs)

CLTs work in reverse: the trust pays a fixed amount to charity for a specified period, then transfers the remaining assets to family members. This strategy is particularly powerful when transferring appreciating assets to the next generation, as future appreciation is removed from your taxable estate.

Private Foundations vs. DAFs

While DAFs have grown tremendously, private foundations still offer unique advantages for very large donors. Understanding the differences helps determine the right structure:

| Feature | Donor-Advised Fund | Private Foundation |

|---|---|---|

| Minimum to Start | $25,000 - $100,000 | $5 million+ |

| Control | Advisory privileges | Full control |

| Tax Deduction Limit | 60% AGI (cash), 30% (stock) | 30% AGI (cash), 20% (stock) |

| Payout Requirement | None | 5% annually |

| Administrative Burden | Minimal | Significant |

| Grant Making Flexibility | Most public charities | Any 501(c)(3) |

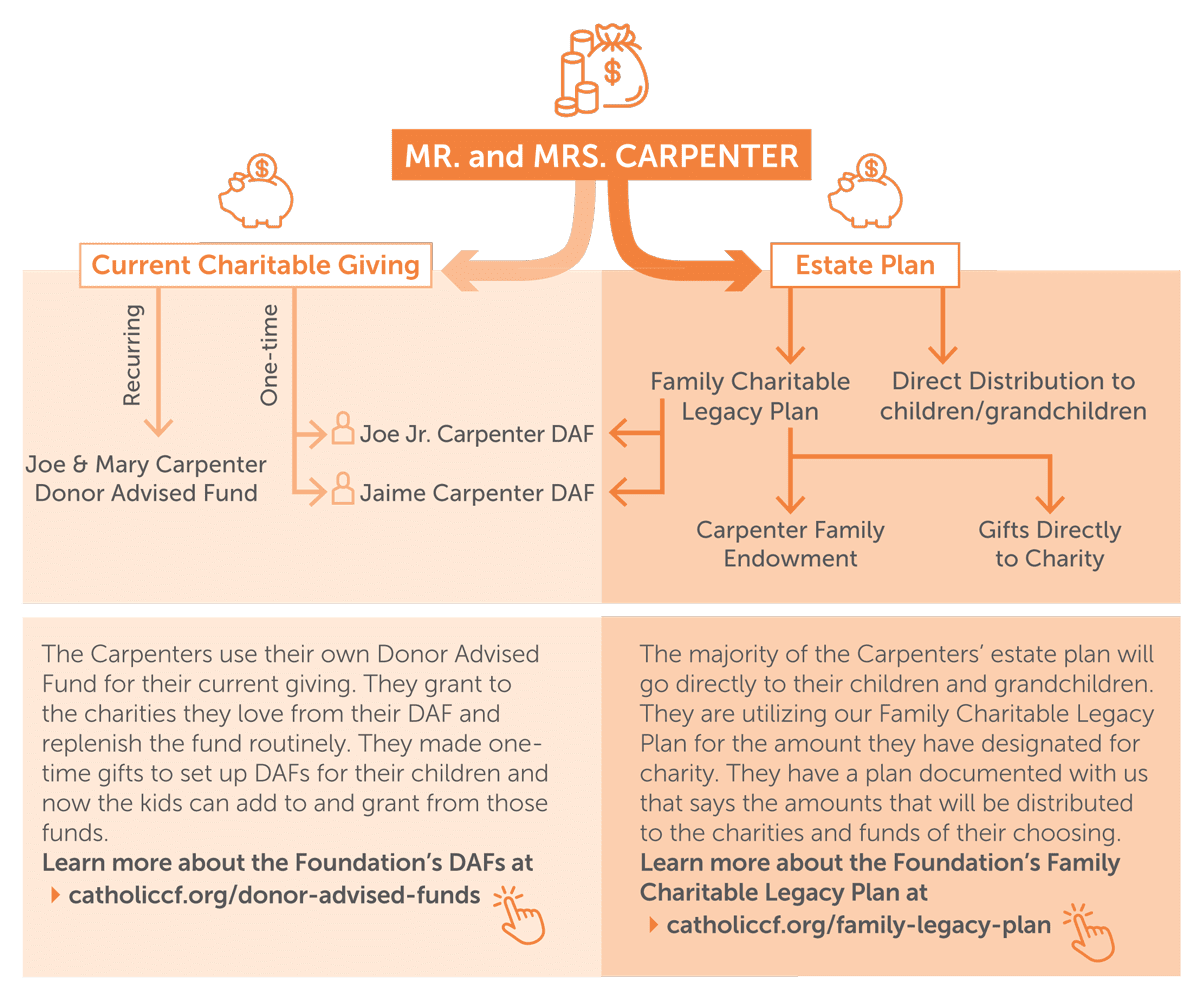

Family Philanthropy and Education

Strategic philanthropy can be a powerful tool for family education and value transmission. Many families use philanthropy to teach children about money management, social responsibility, and the importance of community service.

Engaging Next Generation Philanthropists

- Family Meetings: Regular discussions about charitable goals and selection criteria

- Grant Making Education: Teaching due diligence and impact assessment

- Direct Involvement: Volunteering alongside charitable giving

- Decision Making: Including younger family members in selection processes

- Legacy Discussions: Connecting giving to family values and history

Teaching Through Giving

Families that engage children in philanthropic decision-making often find it to be one of the most effective methods of teaching financial responsibility, critical thinking, and social consciousness. The lessons learned through charitable giving often translate to better business and investment decisions later in life.

Measuring Impact and Effectiveness

Modern philanthropists increasingly focus on measurable outcomes and effective giving. Rather than simply supporting organizations they love, strategic philanthropists analyze the impact of their contributions and adjust their giving strategies accordingly.

Key Metrics for Strategic Philanthropy

- Cost per Beneficiary: Understanding how efficiently resources reach intended recipients

- Long-term Outcomes: Measuring sustainable impact rather than short-term outputs

- Leverage Ratio: How much additional funding philanthropic investments attract

- Innovation Index: Supporting breakthrough solutions versus ongoing operations

- Collaboration Value: Building partnerships that amplify individual contributions

Philanthropy in Today's Economic Environment

The current economic environment presents both challenges and opportunities for strategic philanthropy. Interest rates, market volatility, and tax policy changes all influence the effectiveness of different charitable strategies.

Current Environment Considerations

- Market Volatility: Creates opportunities for strategic gifting of appreciated securities during downturns

- Interest Rates: Higher rates make charitable trusts more attractive for income-oriented donors

- Tax Policy: Changes to deduction limits and tax rates affect strategy selection

- Inflation Impact: Higher inflation makes current deductions more valuable

- ESG Focus: Increasing emphasis on environmental, social, and governance considerations

Strategic Planning Process

Developing an effective philanthropic strategy requires the same careful planning and professional coordination as other aspects of wealth management. The process should integrate with your overall financial and estate planning objectives.

Philanthropic Planning Steps

- Values Assessment: Identify core values and causes that matter most to you and your family

- Capacity Analysis: Determine optimal giving level based on financial circumstances and goals

- Structure Selection: Choose appropriate giving vehicles (DAF, foundation, trusts, direct giving)

- Investment Strategy: Develop investment approach for charitable assets

- Grant Making Framework: Create criteria and processes for evaluating opportunities

- Impact Measurement: Establish methods for tracking and improving effectiveness

- Family Engagement: Plan for involving next generation in philanthropic activities

- Regular Review: Periodically assess and adjust strategy based on results and changes

Working with Professional Advisors

Strategic philanthropy benefits from coordination among multiple professionals, each bringing expertise to different aspects of your philanthropic strategy:

Essential Advisor Team

- Financial Planner: Integrates philanthropy with overall wealth management strategy

- Tax Advisor: Optimizes tax efficiency of giving strategies

- Estate Planning Attorney: Structures trusts and foundation documents

- Investment Advisor: Manages assets within charitable structures

- Philanthropic Consultant: Provides expertise on effective giving strategies

- Legal Counsel: Ensures compliance with complex regulations

Case Study: Integrated Philanthropic Strategy

A successful business owner wanted to create a family legacy while achieving tax efficiency. Working with advisors, she established a DAF with an initial contribution of highly appreciated stock, avoiding significant capital gains taxes. The fund invested conservatively, generating grant income for her priorities while growing the corpus. She involved her adult children in grant decisions, creating a shared family mission. Upon her passing, the remaining assets became a permanent family foundation.

Results: Immediate tax savings, ongoing family engagement, increased giving capacity through investment growth, and lasting legacy establishment.

Common Philanthropic Mistakes to Avoid

Avoiding these common pitfalls can significantly improve your philanthropic effectiveness:

- Insufficient Planning: Making charitable decisions without considering tax and estate implications

- Concentration Risk: Over-reliance on single organizations or causes

- Poor Asset Selection: Giving cash when appreciated securities would be more tax-efficient

- Lack of Strategy: Random giving without coherent vision or measurement

- Ignoring Tax Timing: Not considering the impact of income levels on deduction value

- Foundation Over-Building: Creating private foundations when DAFs would be more efficient

- Inadequate Family Involvement: Missing opportunities to educate and engage next generation

Conclusion: Building Your Philanthropic Legacy

Strategic philanthropy represents one of the most powerful tools available for creating lasting impact while achieving financial objectives. In today's environment, sophisticated philanthropic strategies offer unprecedented opportunities to maximize both charitable impact and personal financial efficiency.

Whether you're just beginning your philanthropic journey or looking to enhance an existing giving program, strategic planning can transform your charitable activities from simple transactions into powerful tools for creating lasting change and achieving your broader financial goals.

The key is to approach philanthropy with the same strategic mindset you apply to your investments and estate planning. Work with experienced advisors, consider all available strategies, and regularly evaluate your approach to ensure it continues to serve both your charitable objectives and your financial goals.

Your Philanthropic Roadmap

Start by clarifying your values and objectives, then work with your advisory team to identify the most effective strategies for your situation. Remember: the goal isn't just to give more—it's to give smarter and create lasting impact that reflects your values and supports your legacy.