Exit Planning for Business Owners: Your Roadmap to Success

For many business owners, their company represents not just their livelihood, but their life's work, their legacy, and their primary source of wealth. Yet according to recent studies, nearly 70% of business owners have no formal exit plan in place. This oversight can lead to missed opportunities, tax inefficiencies, and unnecessary family stress when the time comes to transition.

Critical Insight

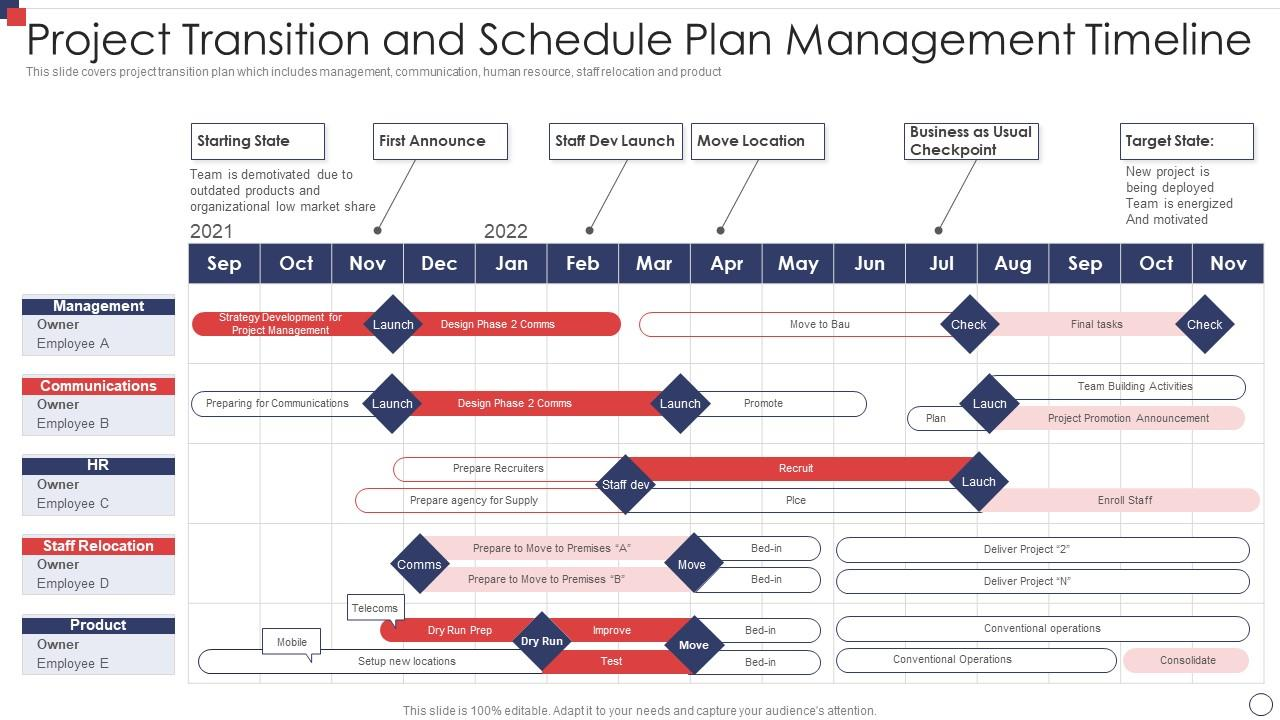

Business exit planning should begin 5-7 years before the intended exit date. This extended timeline allows for strategic value enhancement, tax optimization, and smooth transition management.

Understanding Exit Planning Fundamentals

Exit planning is the process of preparing for the transition of ownership and management of a business to either new owners or existing stakeholders. A comprehensive exit plan addresses four critical components: business value optimization, personal financial planning, family/team succession, and legacy preservation.

The most successful exit strategies balance multiple objectives simultaneously. You want to maximize the financial return from your business while minimizing tax consequences, ensuring continuity for employees and customers, and often maintaining some level of involvement or control in the business you built.

Business Valuation: Know Your Worth

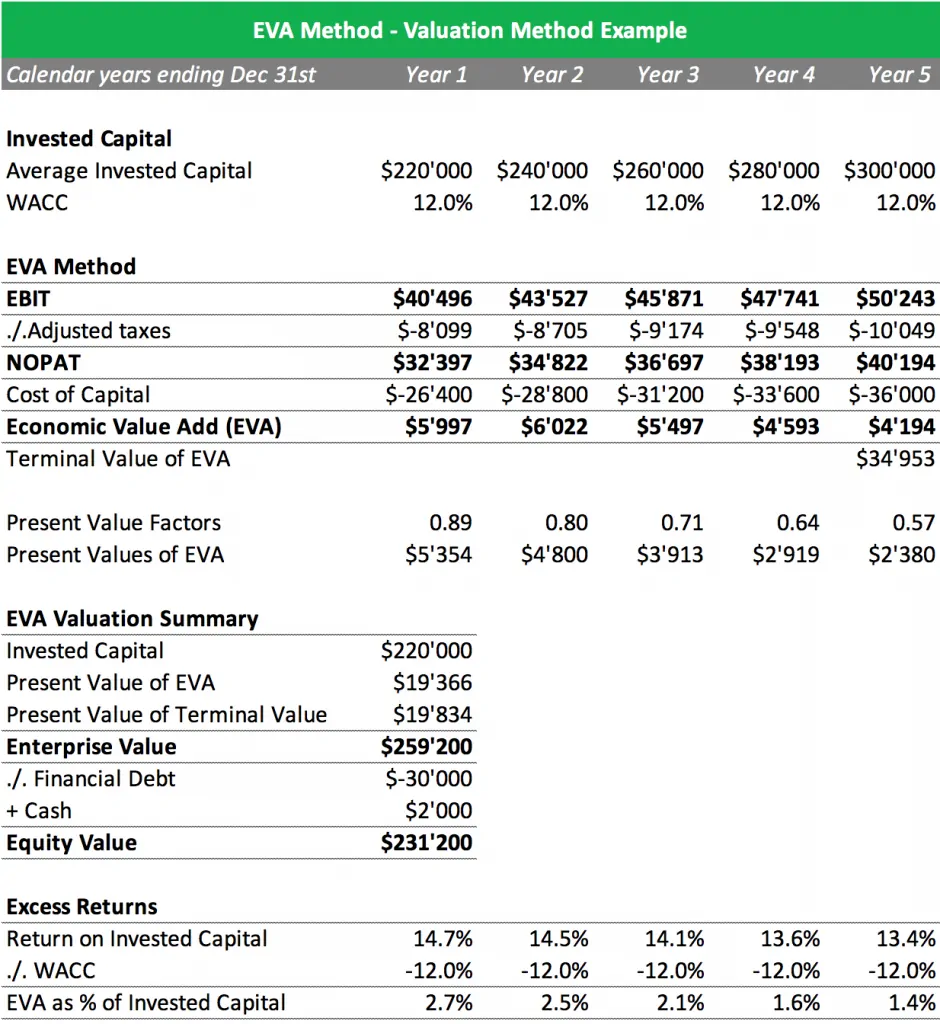

Before engaging in exit planning discussions, it's essential to understand your business's current market value. Professional business valuation considers multiple factors beyond simple revenue and profit metrics.

Key Valuation Methods

| Method | Best For | Typical Multiple | Advantages |

|---|---|---|---|

| Income Approach | Established, profitable businesses | 3-8x EBITDA | Reflects actual cash flow |

| Market Approach | Businesses with comparable sales data | Variable based on sector | Market-driven valuation |

| Asset Approach | Real estate-heavy or asset-intensive businesses | Asset value + goodwill | Conservative approach |

| Discounted Cash Flow | High-growth potential businesses | Future value analysis | Projects future performance |

Exit Strategy Options

1. Management Buyout (MBO)

This strategy involves selling your business to your management team. MBOs provide continuity for employees and customers while often allowing the selling owner to maintain some involvement. The advantages include familiar buyers, reduced disruption, and potentially favorable terms. However, management teams may need external financing, and the transaction can be complex to structure.

2. Family Succession

Transferring the business to family members requires careful planning, especially regarding fairness among children and tax implications. This approach can preserve family legacy but may create family tensions if not handled properly. Consider gradual transitions, education for successors, and clear equity arrangements.

3. Strategic Acquisition

Selling to a competitor or complementary business often provides the highest value, as strategic buyers can achieve synergies. This option requires confidentiality during the process and may involve regulatory considerations. Strategic buyers often pay premium valuations for market consolidation opportunities.

4. Financial Buyer/Search Fund

Private equity firms and search funds actively acquire businesses. This option provides professional management, potential for growth, and often maintains some level of owner involvement. However, you'll typically receive lower valuations than strategic buyers, and the process can be lengthy.

Tax-Efficient Exit Strategies

Strategic Timing

Tax considerations can significantly impact your net proceeds. Work with tax advisors to structure your exit around optimal timing, income brackets, and capital gains tax rates. Installment sales, like-kind exchanges, and charitable remainder trusts are all tools that can optimize your after-tax return.

The tax implications of your business exit can reduce your net proceeds by 20-40% or more. Strategic tax planning should begin well before the actual exit to maximize your after-tax wealth.

Key Tax Optimization Strategies

- Installment Sales: Spread gains over multiple tax years to manage income brackets

- Qualified Small Business Stock (QSBS): Potentially exclude up to $10M or 10x basis from gains

- Charitable Remainder Trusts: Receive income while making charitable gifts

- Like-Kind Exchanges: Defer gains by reinvesting in qualifying replacement property

- Intentionally Defective Grantor Trusts: Transfer future appreciation while retaining income

Enhancing Business Value Before Exit

The preparation period before your exit is critical for maximizing value. Focus on these key areas to enhance your business's attractiveness to buyers:

Operational Improvements

- Document Systems and Processes: Reduce buyer risk by demonstrating repeatability

- Diversify Customer Base: Reduce concentration risk that depresses valuations

- Strengthen Management Team: Demonstrate business can operate independently of owner

- Improve Financial Controls: Ensure clean, accurate financial records for due diligence

Strategic Positioning

- Market Position: Strengthen competitive advantages and market share

- Technology Integration: Modernize systems to appeal to growth-oriented buyers

- Legal Protection: Secure intellectual property and resolve outstanding legal issues

- Operational Efficiency: Optimize margins and cash flow generation

Timing Your Exit

Market timing significantly impacts both valuation and transaction success. Consider these factors when determining the optimal exit window:

Market Conditions

- Interest Rates: Lower rates typically improve buyer financing and valuations

- Industry Consolidation: Active M&A markets drive competitive bidding

- Economic Growth: Strong GDP growth often correlates with higher valuations

- Your Industry Cycle: Time exits during growth phases, not contractions

Personal Factors

- Age and Health: Consider personal energy levels and succession readiness

- Business Performance: Exit during strong performance periods

- Family Circumstances: Align with personal life transitions

- Market Opportunity: Capitalize on strategic buyer interest

Case Study: Tech Manufacturing Success

A 55-year-old owner of a specialized manufacturing company planned his exit over seven years. He implemented systems documentation, diversified the customer base from 5 to 25 major clients, and developed his management team to operate independently. When he ultimately sold to a strategic competitor during a market upswing, the business achieved a 6.2x EBITDA multiple—significantly above the industry average of 4.5x.

Key Success Factors:

- Extended timeline allowed for value enhancement

- Risk diversification improved buyer confidence

- Management development enabled smooth transition

- Market timing captured peak valuation multiples

Due Diligence Preparation

Buyers will conduct extensive due diligence on your business, and their findings will directly impact the transaction terms and price. Prepare thoroughly by organizing documentation and addressing potential issues proactively.

Essential Documentation

| Category | Key Documents | Purpose |

|---|---|---|

| Financial | 3-5 years audited financials, tax returns, AR/AP aging | Verify profitability and cash flow quality |

| Legal | Articles of incorporation, contracts, leases, IP documentation | Assess legal compliance and obligations |

| Operations | Process documentation, vendor agreements, customer lists | Evaluate operational efficiency and risk |

| Human Resources | Employee handbook, compensation records, benefit plans | Understand workforce structure and obligations |

| Technology | Software licenses, IT security policies, system documentation | Assess technical infrastructure and risks |

Post-Exit Financial Planning

The proceeds from your business sale will likely represent your largest single asset. Transitioning from business ownership to personal wealth management requires careful planning and coordination between your financial advisors.

Investment Strategy Considerations

- Liquidity Management: Maintain adequate cash reserves for lifestyle and tax obligations

- Tax Planning: Structure investment portfolio for tax efficiency

- Risk Management: Diversify from business concentration to balanced portfolio

- Legacy Planning: Integrate business proceeds with estate planning goals

- Philanthropy: Consider establishing donor-advised funds or family foundations

Working with Professional Advisors

Exit planning is complex and requires coordination among multiple professionals. Assemble your advisory team early and ensure they work together toward your objectives:

Essential Advisors

- Business Valuation Expert: Provides objective business assessment and benchmarking

- Business Attorney: Handles legal structure, contracts, and transaction negotiation

- Tax Advisor: Optimizes tax efficiency and structures transaction properly

- Financial Planner: Integrates business proceeds with overall wealth plan

- M&A Advisor: Manages sale process and identifies potential buyers

- Insurance Advisor: Addresses risk management and key person coverage

Integration is Key

Ensure all advisors understand your complete financial picture and coordinate their recommendations. The business sale affects tax planning, investment strategy, estate planning, and risk management—all must work together seamlessly.

Common Exit Planning Mistakes

Avoiding these common pitfalls can significantly improve your exit planning outcomes:

- Starting Too Late: Begin planning at least 5 years before target exit date

- Focusing Only on Price: Consider terms, tax efficiency, and strategic fit

- Poor Documentation: Maintain clean, organized business records

- Owner Dependency: Build systems and team that operate independently

- Inadequate Due Diligence Prep: Address potential issues before buyers find them

- Ignoring Tax Planning: Structure transactions for after-tax optimization

- Emotional Decision-Making: Base decisions on financial analysis, not emotion

Conclusion: Your Exit Planning Roadmap

Effective exit planning transforms your business from a job into a valuable asset that can fund your future and support your legacy. The process requires strategic thinking, professional guidance, and careful execution over several years.

Start by understanding your business's current value and potential. Then identify your ideal exit strategy and timeline. Focus on enhancing value through operational improvements and strategic positioning. Work with experienced advisors to structure tax-efficient transactions. Finally, integrate business proceeds into your overall financial plan for long-term success.

Remember: the best time to plan your exit was years ago. The second-best time is now. Whether you're considering selling next year or in a decade, developing an exit plan today puts you in control of your business's future and maximizes the value of your life's work.